Environmental Working Group and most other Food and Environmental groups, and hundreds of Mainstream Media sources, severely misunderstand the farm economy and the Farm Bill.

INTRODUCTION

The Environmental Working Group (EWG) has collected hundreds of editorials that generally support their views of the farm bill, including their focus on farm subsidies and “subsidy reform.” These were then publicized in a series of press releases referring to “252 editorials,” “372 editorials,” “411 editorials,” “475 editorials,” 550 editorials,” “630 editorials,” and “660 editorials,” for example. They represent major newspapers in all of the major U.S. cities and many smaller cities. EWG is the group that operates the Farm Subsidy Database, (https://farm.ewg.org/region.php?fips=00000®ionname=theUnitedStates ) which makes available data obtained from USDA through Freedom of Information.

One example of these summaries of media coverage, (with links to the actual editorials,) is a 2008 EWG press release on Common Dreams (alternative media site,) “372 Editorials Call for Farm Bill Reform.” (Original link to the press release: http://www.commondreams.org/news2008/0211-10.htm , now see https://www.ewg.org/successes/2008/winning-debate-just-not-vote-farm-subsidy-fairness#.WuMNGDvxZ9Q, https://www.ewg.org/release/more-630-editorials-call-farm-bill-reform#.WuMLATvxZ9Q and https://www.ewg.org/research/all-over-map#.WuMIKzvxZ9Q.)

EWG argued that “Two main themes emerge from these editorials.” First, they argued that subsidies go “to wealthy individuals and operations that do not need support,” for example, compared to “nutrition and conservation” programs. A key assumption, then, was that farm subsidies should be reduced, with the money going to these other programs. Second, EWG found the George W. Bush administration to be “far more progressive and reform minded than the Democratic leadership of the House and Senate when it comes to matters of equity and fairness in subsidy payments.”

There are major flaws in EWG’s analysis in this press release and in all others. In general, while the main farm commodity programs are terrible programs the EWG analysis and the editorials don’t explain why or how this is true. In reading hundreds of these editorials, I’ve found none to be correct about any of the basic questions raised by EWG.

THEME I: THE FARM SUBSIDY MYTH

What EWG and the editorial writers apparently didn’t know, and still don’t know, is that the original and early farm bills were designed to fix the economic problem of a “lack of price responsivensess” (http://agpolicy.org/weekcol/248.html ) “on both the supply and the demand side for aggregate* agriculture,” (http://agpolicy.org/weekcol/325.html ,) (*for farming markets as a whole as they occur across the various regions). This was a problem for 60 years prior to the farm bill, and continues today, (see p. 5 here http://agpolicy.org/publication/NFU-April2012-FinalReport-AsSentToNFUApr2-2012.pdf ) with CBO and USDA-ERS projections of it continuing for another 10 years. The main result was chronic low farm prices, below the full costs of production. The farm bill fixed the problem with market management of price and supply. On the bottom side, (for the main problem,) price floors were used, backed up with supply reductions, (as needed to balance supply and demand from year to year). On the top side, price ceilings triggered the release of reserve supplies, as needed to moderate price spikes. These programs worked well when well managed.

The history of the problems, leading to the recent period, is that Price Floor programs were reduced, more and more and more, from 1953-1995, and then ended (1996-2018). Similar changes occurred for livestock and for fruits and vegetables, where programs supported prices in “less direct” ways. The price reductions were implemented by Congress to allow market failure to force farmers to subsidize (via cheap prices) the huge corporate buyers of grains, fruits and vegetables, and other farm products, and through them, to subsidize consumers.

Subsidies, which were occasionally paid to growers of a few crops during the early years, had only tiny impacts in these early farm bills, and there were no subsidies from 1944 (or earlier, or none,) until 1961 for corn and wheat, 1962 for barley, 1964 for cotton, 1977 for cotton, 1982 for oats, 1998 for soybeans, and never for rye and other crops. These subsidies made up for only a small fraction of price reductions, (about 13% on average). These enormous, ongoing and increasing injustices are totally ignored by EWG and in virtually all of the hundreds of editorials.

The programs have been so bad for farmers that most of them have been run out of business during the period of reductions and compensatory subsidies. Market prices were below full costs** every year except one, 1981-2006, for a sum*** of 8 major crops. (**Full costs figures include a wage equivalent for the farmer, so the losses are on the farmer’s investments in land, machinery and facilities. See the raw data here: https://www.ers.usda.gov/data-products/commodity-costs-and-returns/) (***The sum of 8 crops is calculated as follows: full cost/acre minus income per acre for each crop, as measured by USDA-ERS, then all 8 are summed.) Dairy has been below full costs every year since 1993, except for 2007 by a few pennies per gallon.

Although yields increased dramatically over this period, and subsidies sometimes increased, farmers often made less money per acre. In USDA-ERS studies that include subsidies for 6 major crops, each crop was below zero vs full costs over all. (Over various time periods, corn, cotton, rice, barley, sorghum, and including soybeans, which had no subsidies. I have this data, but I can no longer find it online.) Even in recent years, net farm income has sometimes fallen to less than half of what it was during the 1940s. The major subsidized crops, (corn, wheat, soybeans, rice and cotton,) have each performed more poorly, (as measured by percent of parity,) than virtually all (i.e. 45) important fruits and vegetables, even if subsidies are included in the calculations, though fruits and vegetables have also fallen dramatically.

What we see, then, is that, with Congress reducing and eliminating minimum price floor programs, agriculture has desperately “needed” farm subsidies, (especially for the subsidized crops).

The question of rich beneficiaries who do not need benefits also begs for accurate analysis. First, who has stayed in business under these conditions? Increasingly it’s been those with off farm income. In 1960 the ratio of off farm income to farm income for farming households was about 1 to 1. By the 2000s it had grown as high as 10 to 1 for extended periods, and even as high as 20 to 1 on bad farming years. The key here is that farm losses provide tax write-offs for off farm income, and the richer the tax bracket, the the bigger the tax subsidy per acre. For example, the top bracket gets nearly 4 times more than the 10% bracket, per acre, assuming identical farms. We see, then, that major tax reforms are needed as well. This, then, complicates the question of those who are rich, (from off farm income,) getting subsidies for huge farm reductions and losses, (caused by bad farm bills from Congress, in a context of chronic market failure).

Even more dramatic, and totally left out of EWG’s analysis and the editorials, is the question of the real beneficiaries of these programs, the corporate buyers. While all farm subsidy recipients first face huge reductions in prices and incomes, (with the greatest quantity of reductions going to the biggest farms,) the buyers get their much bigger benefits, and they get them without any prior reductions. Instead they’ve often had record high incomes and returns on equity (often in the high teens or well into the 20% range, or even in the 30% or 40% range). (See A.V. Krebs, the Corporate Reapers, pp. 48 & 419, and this report: http://www.nfu.ca/sites/www.nfu.ca/files/corporate_profits.pdf .) Meanwhile, farm incomes have fallen, more and more, and returns on equity for agriculture have usually been in single digits, and only rarely in the teens (i.e. since 1960).

So there is no “means testing” for these (much much larger) corporate beneficiaries,(https://zcomm.org/zblogs/de-mystifying-means-testing-for-commodity-farmers-by-brad-wilson/ ,) and no transparency as to their subsidies, no public database for the much larger corporate subsidies taken from farmers to give to corporate buyers. Additionally, these larger farmer-to-buyer “subsidies,” since they result from market failure, don’t show up at all in farm bill spending pie charts,(https://www.slideshare.net/bradwilson581525/the-hidden-farm-bill-37959389 ) nor do USDA subsidy maps (https://www.slideshare.net/bradwilson581525/farm-bill-net-impacts-which-state-is-the-biggest-loser ) and articles, (i.e. analysis of subsidy impacts,) take account of them.

While the biggest 4 corn farmers have well under 1% market share,, (i.e., as estimated from the farm subsidy database rankings,) there are huge market shares for various groups of buyers, such as hog and poultry CAFO corps, (top 4 around 50%, http://www.ase.tufts.edu/gdae/Pubs/rp/CompanyFeedSvgsFeb07.pdf ) and exporters (top 3 probably around 80% according to experts, personal communication, but see https://www.researchgate.net/publication/304077247_Vertical_Integration_and_Concentration_in_US_Agriculture ). So the benefits are much much greater per recipient among the corporate buyers, (who’s rate of benefit per unit is 8 times greater than that of farmers, and with no prior reductions, i.e. compared to the farmers who pay these [8 times greater] benefits).

Neither EWG nor any of the editorials demonstrates any knowledge of any of this context either. In arguing for taking money from farmer victims to feed the hungry, they’re penalize one victim group to favor another. In the meantime, strategically and politically, subsidy related farmer bashing and victim blaming leads groups like EWG to be severely divided and conquered, (divided from those who could save them from these severe mistakes, where they end up supporting the biggest exploiters, such as the biggest benefits for junk foods, CAFOs, and export dumpers).

THEME II: THE WRONG SIDE OF FARM BILL POLITICS

The analysis above shows how EWG and hundreds of the editorial writers, (those that discuss proposals from the Bush administration,) were also wrong on the second major theme. The Bush administration, EWG and the editorial writers, in ignoring the need for farm justice more than the Democratic leadership does, are less progressive, not more.(On this point see: http://agpolicy.org/weekcol/589.html and https://zcomm.org/zblogs/ewg-s-ken-cook-debates-former-ag-chair-larry-combest-loses-by-brad-wilson/ ) Real reform, however, requires restoration of market management programs at adequate levels, to eliminate the need for subsidies.(See the major current proposals here: https://zcomm.org/zblogs/primer-farm-justice-proposals-for-the-2012-farm-bill-by-brad-wilson/ .) So none of the above are reformers.

THE MYTH OF “RECORD HIGH” FARM PRICES AND FARM INCOME

Farm Price Records

EWG further claimed, falsely, that the farm economy had seen “record high farm income and record high prices for many crops.” This falsehood has also gone viral all across mainstream media.(i.e. http://www.thegazette.com/2011/03/09/price-of-corn-not-really-a-record ) In fact, however, the much higher prices of 2007 and 2008 were small fractions of the real record highs, (i.e. only about 25% or less of record highs for corn, wheat and rice). They just seemed high because they followed decades of lower and lower farm prices, with the lowest prices in history occurring, over and over, from 1997-2005, (i.e. 8 of the 9 lowest for both corn and soybeans, and similar for other crops; I’ve crunched these numbers). EWG andmainstream media have totally ignored this massive context of hard times on the farm. In the case of The Gazette, (Cedar Rapids,) in the letter linked above, for example, since they regularly buy syndicated articles, and since these articles sometimes contain claims of “record high farm prices,” they can’t help further spreading the myth.

Net Farm Income

Likewise, even with greatly increased yields, Net Farm Income for 2007 and 2008 was well under 75% of 1942-1952, when all 11 years were higher. Only 2013, (later, and following the drought of 2012,) showed a Net Farm Income higher than some years in the earlier period, (and it did not rate in the top 6, including 1973, the record high). 2016 and 2017 Net Farm Incomes, (and projections ahead 10 more years,) are all below 50% of Net Farm Incomes during 1942-52. (Note that all of these recent net farm incomes, including all projections, include farm subsidies.)

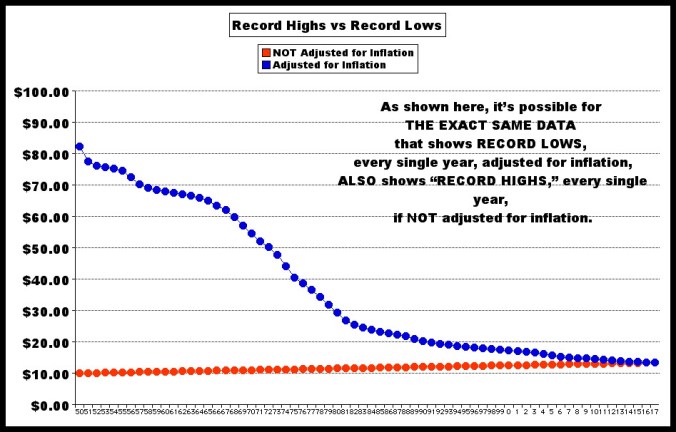

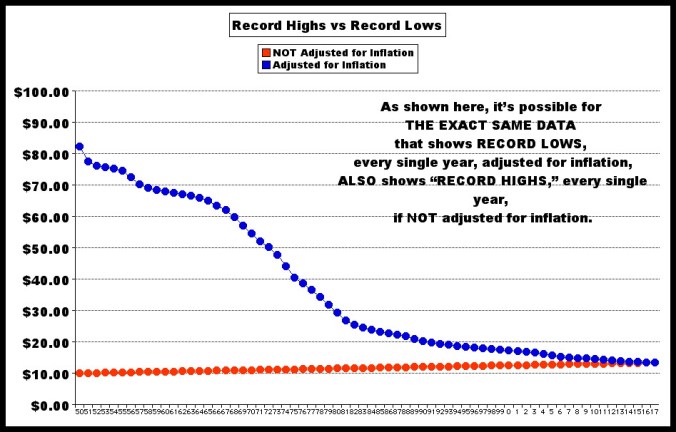

The Absurdity of NOT Adjusting for Inflation

Perhaps we can assume that the myth of record high farm prices is explained by simply not adjusting for inflation. In that case, here locally, a June 2008 price for a bushel of corn was $7.01, and a few days later, in June, the price hit $7.03. Really, however, it’s absurd to call that a record high when it’s less than half of the real record high, of $2.16 in 1947, (when it’s only 91¢ in 1947 dollars, GDP deflator). ($2.16 iwas $16.80 in 2008 dollars In that method, for many items that follow inflation closely, every absurdly flawed. Complaining about low wages? “Your last pay raise was a ‘record high.’ Stop complaining.”

In fact, it’s possible for a statistic to be a record low every single year, nominally, andyet really be a record high, also every single year, if you adjust for inflation!

CONCLUSION: MEDIA COVERAGE OF THE FARM BILL

We see, then, that the two main themes identified by the Environmental Working Group in the 372 mainstream media editorials it obtained are both essentially false. A major problem with them is that subsidies aren’t at all the real problem. Subsidies are a form of justice for farmers, (not injustice,) but they’re also seriously inadequate. Really there should be fair prices, with no need for any subsidies. While there has been a lot of writing on farm bill issues in recent years by mainstream media and among Environmental, Hunger, Food and other progressive organizations, virtually all of it has been so false as to be the opposite of the claims made about farm bill reform. It has led countless organizations to unknowingly side with agribusiness exploiters, include junk food makers, animal factories, and export dumpers, all otherwise severely criticized these days by these same groups. Mainstream and alternative media, for their parts, do not perform any better when it comes to the core farm bill issues.